- Understanding Exness Deposit Terms and Policies

- Starting Your Trading Experience with Exness

- Starting Your Trading Journey with Exness: Comprehensive Insights on Funding Options and Costs

- Currency Options for Exness Accounts: Tailored for Global Flexibility

- Security Protocols to Protect Your Funds at Exness

- FAQ: Deposits and Currency Options at Exness

An Overview of Exness Minimum Deposit Requirements

Exness tailors its minimum deposit criteria based on the account type selected and the trader’s location, offering a flexible approach that caters to both new and seasoned traders. This adaptable structure allows each trader to begin trading according to their financial goals and level of experience.

- Standard Accounts: With the Standard account, new traders can start trading with a minimal initial deposit, as low as $1 in some regions. This low barrier of entry reduces financial pressure, offering newcomers an accessible way to start trading and gain confidence in the markets.

- Professional Accounts: For traders with more experience seeking advanced features, Exness offers account types such as Raw Spread, Zero, and Pro. These accounts generally require a minimum deposit of $200, providing more sophisticated trading conditions, like tighter spreads. Such features are beneficial for those using high-frequency trading strategies or trading larger volumes.

This structured deposit model enables traders to choose an account type that aligns with their trading style and financial capabilities, positioning Exness as a versatile broker suitable for all experience levels.

Understanding Exness Deposit Terms and Policies

Exness has earned a reputation for its favorable deposit conditions, structured to enhance the effectiveness of traders’ investments. Here are the core aspects of Exness’s deposit policies:

- Currency Conversion: Exness does not charge deposit fees, but traders should be mindful of possible currency conversion charges. When deposits are made in a currency different from the account’s base currency, conversion occurs, typically at competitive rates. However, exchange rate fluctuations may influence the final amount credited to the account.

- Instant Processing: Most deposit transactions on Exness, particularly those via e-wallets or credit cards, are processed instantaneously. This rapid transaction speed allows traders to seize market opportunities promptly without waiting for funds to appear in their accounts.

- Transparency: Exness values transparency, ensuring that traders are fully informed of any associated costs upfront. While Exness itself does not impose deposit fees, certain charges from banks or payment providers may apply. This clarity minimizes unexpected fees, making the trading experience smoother.

- Flexible Payment Options: Exness supports a wide range of payment methods, including bank transfers, credit/debit cards, and popular e-wallets like Neteller, Skrill, and WebMoney. By offering multiple options, Exness caters to its global client base, providing accessible and convenient deposit solutions worldwide.

With a trader-focused deposit framework, Exness makes it easier for clients to access their trading accounts, enhancing the overall trading experience with efficient fund management options. This dedication to seamless financial interactions establishes Exness as a preferred broker for those seeking reliability and flexibility.

Starting Your Trading Experience with Exness

Getting started with Exness is designed to be straightforward, supporting both newcomers and experienced traders. Here’s a step-by-step guide:

- Create Your Account

- Sign-Up: Begin by visiting the Exness website and completing the registration form with your details (name, email, and phone number).

- Verification: For security and regulatory compliance, you’ll need to verify your identity. This typically involves uploading documents such as a passport or driver’s license and a recent utility bill to confirm your address.

- Make Your First Deposit

- Choose Your Deposit Amount: Depending on the type of account you select, you will need to meet the minimum deposit requirement. For Standard accounts, this may be as low as $1, whereas professional accounts (Raw Spread, Zero, Pro) may require $200.

- Select a Payment Method: Exness offers multiple deposit methods, including bank transfers, credit/debit cards, and various e-wallets. Choose the option that suits your needs.

- Complete the Deposit: Follow the instructions to complete your deposit. Most transactions are processed instantly, allowing you to start trading almost immediately.

- Begin Trading

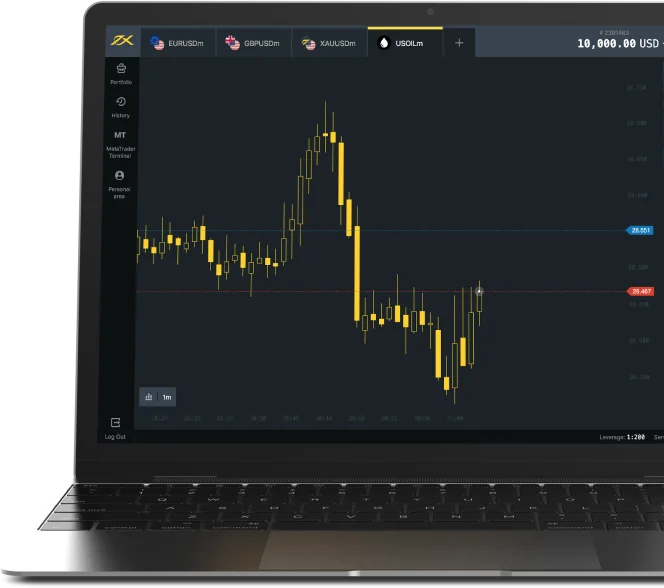

- Access Trading Platforms: Once your account is funded, you can access Exness’s trading platforms, including MetaTrader 4 and MetaTrader 5. Known for their powerful features and ease of use, these platforms cater to all levels of trading expertise.

- Explore Market Opportunities: With access to forex, commodities, indices, and cryptocurrencies, Exness offers a broad array of trading instruments to suit diverse trading strategies.

- Leverage Tools and Resources: Take advantage of the analytical tools, educational content, and dedicated support from Exness to enhance your trading success.

Ensuring a Successful Trading Start

To maximize your trading potential, Exness provides several resources and tools to support your journey:

- Educational Resources: Make use of Exness’s educational materials, such as tutorials, webinars, and articles, to deepen your understanding of market behavior and refine your strategies.

- Demo Account Practice: A demo account is invaluable for new traders, as it allows them to practice with virtual funds, familiarize themselves with the trading platform, and test out strategies risk-free.

- Set Clear Goals: Define what you aim to achieve through trading, whether it’s building consistent profits or learning new techniques. Clear goals provide motivation and a benchmark for tracking your progress.

Commitment to Long-Term Success

Exness supports traders in achieving sustained success through continuous learning and disciplined trading practices:

- Stay Informed: Keep up with financial news and market trends. Exness provides real-time data and analysis, equipping you with insights that are crucial for making informed trading decisions.

- Risk Management Practices: Implement solid risk management techniques, including setting stop-loss orders to limit potential losses and adjusting trading volumes based on your comfort with risk.

By following these steps and leveraging Exness’s comprehensive resources, you’ll be well on your way to a successful trading career. Exness’s dedication to a secure and supportive trading environment makes it an outstanding choice for traders aiming to excel in global financial markets.

Starting Your Trading Journey with Exness: Comprehensive Insights on Funding Options and Costs

Exness offers a variety of funding options tailored to accommodate its diverse global clientele, enhancing ease of access and convenience. This guide breaks down the various deposit methods, associated costs, and account currency options to help traders manage funds efficiently.

Detailed Overview of Funding Methods at Exness

Exness provides multiple deposit methods to meet local preferences and embrace new financial technologies, ensuring that every trader can find an option that fits their needs:

- Local Bank Transfers: Exness supports local bank transfers, minimizing currency exchange requirements and expediting fund availability. This is ideal for traders who prefer transactions within their local banking infrastructure.

- Prepaid Cards: For those who value privacy or prefer not to use traditional bank accounts, Exness offers several prepaid card options. These provide a secure and regulated way to fund accounts without directly linking to a bank account.

- Mobile Payments: Recognizing the growing reliance on mobile technology, Exness supports mobile payment options in select regions, making it easier for traders who manage finances on the go.

- Region-Specific Payment Systems: To further accommodate regional needs, Exness integrates regionally popular payment systems, providing tailored deposit options for traders in specific countries.

- Unlimited Deposit Ceilings: Exness places no maximum limit on deposits, accommodating both high-volume traders and beginners. Minimum deposit requirements start as low as $1 for some accounts, making Exness accessible to traders with varying capital levels.

This diverse range of funding options ensures that Exness clients can initiate trading quickly and seamlessly, choosing the method that aligns with their preferences and needs.

Exness’s Deposit Fee Structure and Cost Transparency

Exness is committed to cost-effectiveness and transparency, typically waiving internal deposit fees. However, traders should be aware of potential external costs:

- Third-Party Fees: While Exness does not charge for deposits, certain banks or payment processors may impose their own fees. These are external to Exness and can vary by provider.

- Currency Conversion Fees: When deposits are made in a currency different from the account’s base currency, currency conversion fees may apply. These fees are determined by the payment processor and may fluctuate based on exchange rates.

Additional Deposit Details:

- Currency Conversion Awareness: To avoid unexpected costs, traders should check for any conversion fees if depositing in a different currency than their account’s base.

- Minimum Deposit Requirements: These may vary by location and selected payment method, so it’s essential to verify applicable thresholds.

- Enhanced Security Protocols: Exness uses stringent security measures to safeguard all transactions, including additional verification for certain payment methods.

Steps for Depositing Funds into Your Exness Account

Funding your Exness account is designed to be user-friendly and secure, enabling you to capitalize on market opportunities promptly. Here’s a step-by-step guide:

- Access Your Account: Log in to your Exness Personal Area on the official website using your credentials.

- Navigate to Deposits: Find the ‘Deposit’ section, available on your dashboard or under financial services.

- Choose a Deposit Method: Select from the range of available methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrency.

- Input Deposit Details: Enter the amount you wish to deposit and any required information. Be sure to review limits and any possible fees before proceeding.

- Verify Currency and Information: Confirm that the deposit currency aligns with your account’s base currency to avoid conversion fees. Double-check all details for accuracy.

- Complete Security Verification: Follow any necessary security checks, such as two-factor authentication or email confirmations, to secure your transaction.

- Finalize the Deposit: Submit the deposit. You should receive on-screen confirmation, and possibly an email notification.

- Check Account Balance: Return to your dashboard to confirm the updated balance. Funds should appear instantly for most electronic methods, while bank transfers may take longer.

Currency Options for Exness Accounts: Tailored for Global Flexibility

Exness offers a wide variety of account currency choices, allowing traders to select an option that best suits their trading style, location, or investment strategy. This flexibility minimizes conversion fees and enhances financial efficiency.

Available Currencies Include:

- Major Currencies: USD, EUR, GBP, and JPY are available, catering to traders who prefer widely recognized global currencies.

- Commodity-Linked Currencies: AUD, CAD, and NZD provide options tied to economies with significant natural resources.

- Emerging Market Currencies: CNY, RUB, and BRL are options that support traders in emerging markets, enabling localized currency management.

- Cryptocurrencies: BTC, ETH, and LTC options allow traders with an interest in digital finance to operate in cryptocurrency.

- Region-Specific Currencies: Options like KWD, SAR, and INR offer tailored choices for traders in specific regions.

This broad selection of currencies emphasizes Exness’s dedication to providing a personalized trading experience, reducing the likelihood of unnecessary conversion costs and supporting efficient fund management.

Security Protocols to Protect Your Funds at Exness

Exness prioritizes the security of client transactions with advanced safeguards:

- Continuous Monitoring and Risk Management: Automated systems detect and prevent unauthorized activities, maintaining account integrity.

- Two-Factor Authentication (2FA): This added layer of security requires a secondary verification step, significantly reducing the risk of unauthorized access.

- Data Protection Standards: Adherence to strict data privacy laws and advanced encryption technology ensures that client data remains secure.

- Customizable Security Features: Traders can customize account security settings, including withdrawal confirmations and login notifications, for enhanced protection.

- Educational Resources: Exness provides educational materials to help traders recognize and prevent security threats.

- Dedicated Support Team: The Exness support team is available to address any security concerns, providing prompt and expert assistance.

Exness’s robust security measures ensure that traders can confidently manage funds within a safe environment tailored to individual needs, complemented by diverse funding options and account currency flexibility.

FAQ: Deposits and Currency Options at Exness

Are There Any Fees for Depositing Funds into My Exness Account?

Exness does not charge internal deposit fees. However, third-party fees from banks or payment processors may apply, particularly for currency conversions.