Getting Started with the Exness Web Terminal

Quick Access:

- Access the Web Terminal: Visit the Exness website and select the ‘Web Terminal’ option under the ‘Trading’ section.

Logging In:

- Account Credentials: Use your Exness account login details to access the platform. If you’re new, you can easily create an account on the Exness homepage.

Familiarizing with the Platform:

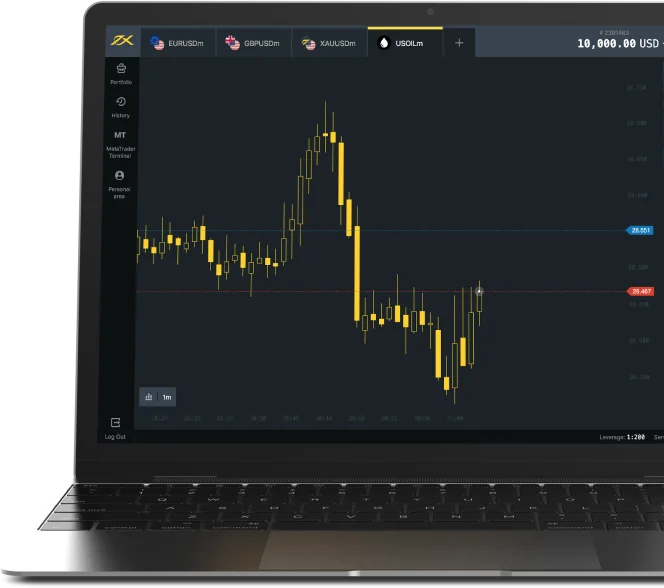

- Exploring the Layout: Spend a few moments getting acquainted with the platform layout. This helps in quickly locating essential features, allowing you to trade efficiently.

Setting Up Your Trading Dashboard:

- Customizing Charts and Tools: Adjust your trading charts and add any tools or indicators you frequently use.

Funding Your Account:

- Deposits: Ensure your trading account is funded, which can be done easily through your Exness Personal Area.

Placing Trades:

- Market Analysis: Use the available tools to analyze trends and place trades by selecting your preferred instruments and defining order types.

- Risk Management: Use stop-loss and take-profit features to manage risks effectively.

Key Features of the Exness Web Terminal

User Interface:

- Simplicity and Intuitiveness: With a user-friendly design, the Web Terminal is accessible for both new and experienced traders.

- Browser-Based Access: The platform is accessible from any web browser, enhancing flexibility and ease of access.

Trading Capabilities:

- One-Click Trading: Place trades quickly with one-click options, ideal for fast-moving market opportunities.

- Real-Time Price Feeds: Access up-to-the-minute price updates for all trading instruments.

Analytical Tools:

- Advanced Charting Options: Access multiple chart types and technical indicators for in-depth market analysis.

- Integrated Economic Calendar: Stay aware of major economic events that may influence trading conditions.

Security Measures:

- Secure Access: SSL encryption protects login credentials and trading data.

- Data Privacy: Exness prioritizes the confidentiality of personal and financial information.

Device Compatibility:

- Cross-Device Compatibility: Use the Web Terminal on PCs, tablets, and smartphones without sacrificing performance.

Customer Support:

- Integrated Assistance: Get help directly from the platform, making it easier to resolve issues as they arise.

Optimizing Your Web Terminal Setup for Enhanced Trading Performance

Personalizing the Layout:

- Customize Chart Layouts: Organize the platform’s layout to position frequently used features conveniently. This boosts your workflow efficiency.

- Adjust Chart Settings: Choose your preferred chart type, such as candlestick or line charts, and adjust colors for enhanced readability.

Adding Indicators and Tools:

- Technical Indicators: Equip your charts with indicators like Moving Averages, MACD, or RSI to support your analysis.

- Graphical Analysis Tools: Use tools like Fibonacci retracement and trendlines to map out price levels and potential market reversals.

Setting Trading Preferences:

- Order Preferences: Set default lot sizes, leverage, stop-loss, and take-profit levels to streamline order placements.

- Price Alerts: Enable alerts for key price levels or market events, so you remain informed without constantly monitoring the market.

Executing Trades Efficiently on the Exness Web Terminal

Trade Placement:

- Choosing an Instrument: Select your financial instrument from the Market Watch list.

- Setting Orders: Click on ‘New Order’ and input trade details, including volume and any desired risk management settings.

- Confirming the Trade: Once ready, click ‘Buy’ or ‘Sell’ to execute your trade.

Managing Pending Orders:

- Setting Pending Orders: Choose pending order types, such as Buy Limit or Sell Stop, and specify your target entry level.

- Customizing Order Details: Define volume, stop-loss, and take-profit settings.

- Order Execution: The trade will be executed automatically once your criteria are met.

Modifying and Closing Trades:

- Order Adjustments: Go to the ‘Trade’ tab, right-click on the order, and select ‘Modify or Delete Order’ to update settings.

- Closing Trades: Right-click on an open trade in the ‘Trade’ tab and select ‘Close Order’ to exit the position.

The Exness Web Terminal offers an intuitive and robust platform that simplifies trading, whether you’re configuring the interface or setting up technical tools. With its web-based functionality, Exness provides a seamless trading experience, allowing traders to maximize potential from anywhere with an internet connection.

Advanced Trading Strategies for Exness Web Terminal

The Exness Web Terminal enables traders to execute complex trading strategies using real-time data, customizable charts, and a suite of tools. Here are some advanced strategies to enhance your trading effectiveness on this platform.

1. Trend Following Strategy

- Setup: Trend following involves trading along the market’s prevailing direction. Use indicators like Moving Averages (SMA or EMA) and the MACD to gauge the market trend.

- Moving Averages: SMAs help smooth price data over time, while EMAs give more weight to recent prices. Rising MAs suggest an uptrend; falling MAs indicate a downtrend.

- MACD: This indicator highlights trend strength and changes, providing buy signals when the MACD line crosses above the signal line.

- Execution: In an uptrend, consider buying on pullbacks to support levels. For downtrends, wait for retracements to resistance before selling.

- Risk Management: Set stop-losses below support in uptrends and above resistance in downtrends to control risk.

2. Range Trading Strategy

- Setup: Range trading focuses on buying at support and selling at resistance. Use Bollinger Bands or the Stochastic Oscillator to detect overbought or oversold levels within a defined range.

- Bollinger Bands: When prices touch the lower band, it indicates potential oversold conditions; the upper band signals potential overbought conditions.

- Stochastic Oscillator: This tool identifies reversal points by comparing closing prices to the price range over a certain period.

- Execution: Buy when the price nears support and sell near resistance. Use Bollinger Bands to confirm entries.

- Risk Management: Place stop-losses outside the range boundaries to protect against unexpected breakouts.

3. Scalping Strategy

- Setup: Scalping aims to profit from tiny price movements through quick trades. Set the Web Terminal to 1-minute or 5-minute charts to closely monitor these movements.

- Real-Time Quotes: The Web Terminal’s live price updates support timely decision-making.

- Time Frames: Use short intervals to stay on top of small market shifts.

- Execution: Make frequent trades based on short-term price movements. Aim to capture small profits repeatedly.

- Risk Management: Use tight stop-losses and take-profits. Scalping demands quick reactions, so avoid holding positions too long.

4. News Trading Strategy

- Setup: News trading capitalizes on market volatility following significant economic announcements. Use the integrated economic calendar to stay aware of major events.

- Economic Calendar: Track upcoming economic reports and releases that can impact market movements.

- Execution: Anticipate market direction based on the expected outcome of an event. For example, if a report is expected to show strong economic growth, you might enter a long position in the related currency pair.

- Risk Management: Use wider stop-losses, as news releases can cause volatile price swings.

Implementing Strategies in the Exness Web Terminal

Utilizing Platform Tools:

- Technical Indicators: Add indicators like MACD, RSI, and Bollinger Bands to your charts to support your chosen strategy.

- Chart Customization: Adjust chart settings and layouts to suit your preferences and trading style.

Risk Management Practices:

- Leverage Control: Adjust leverage based on your risk tolerance. High leverage can magnify gains but also increases potential losses.

- Stop-Loss and Take-Profit: Implement stop-loss and take-profit settings for each trade to maintain control over your risk exposure.

Continuous Improvement:

- Strategy Refinement: Periodically review your trading performance and refine your strategy based on past outcomes.

- Stay Updated: Keep informed on global market news and adjust strategies to align with current economic conditions.

The Exness Web Terminal’s features, from customizable technical tools to responsive charts, make it an adaptable platform for traders implementing a variety of strategies. By setting up the terminal according to your trading style and employing effective risk management, you can optimize your trading experience and potentially enhance profitability.

Advantages and Disadvantages of the Exness Web Terminal

Advantages:

- Easy Access from Any Device: With only an internet connection and browser, you can access the Exness Web Terminal, providing the flexibility to trade anywhere without additional downloads.

- Intuitive User Interface: Both beginners and experienced traders will find the Exness Web Terminal easy to navigate, featuring essential tools like customizable charts and technical indicators.

- Real-Time Market Data: Instant access to real-time price updates across various instruments keeps traders informed of live market movements.

- Comprehensive Tools: The platform includes a range of technical indicators, charting options, and an integrated economic calendar, facilitating in-depth analysis within the terminal.

- Hassle-Free Maintenance: As a fully web-based solution, Exness handles all platform updates, allowing traders to focus exclusively on their trading activities.

Disadvantages:

- Limited Advanced Customization: While the Web Terminal includes essential features, it may lack some advanced customization capabilities compared to downloadable platforms like MT4 or MT5.

- Potential System Resource Demand: As a browser-based platform, the terminal may use more system resources, impacting performance on devices with limited processing power or multiple open applications.

Detailed Comparison: Exness MT4 and MT5 Web Terminals

Exness provides web-based versions of both the MT4 and MT5 platforms, enabling powerful trading capabilities combined with the convenience of browser access. Here’s an in-depth comparison of each to help you decide which platform best fits your trading needs.

Exness MT4 Web Terminal Overview

The Exness MT4 Web Terminal brings the popular MetaTrader 4 interface to your browser, ideal for traders who prioritize mobility and accessibility.

Key Features:

- Anywhere Access: Use any internet-connected device to trade directly through a browser, without installing software.

- Core MT4 Functionality: Offers all essential MT4 tools, including live charting, trade execution, and real-time price quotes.

- Technical Analysis Tools: Comprehensive indicators and graphical tools are available for multi-timeframe analysis.

- One-Click Trading: Fast trade execution is especially useful for traders who need to respond quickly to market shifts.

Exness MT5 Web Terminal Overview

The Exness MT5 Web Terminal offers enhanced functionality for traders seeking more comprehensive tools and analysis capabilities compared to MT4.

Key Features:

- Advanced Order Types: The MT5 web terminal includes additional order types like Buy Stop Limit and Sell Stop Limit, along with a depth of market display.

- Expanded Charting and Analysis: MT5 provides more timeframes, additional technical indicators, and superior graphical tools for advanced market analysis.

- Integrated Economic Calendar: The economic calendar helps traders stay aware of key events impacting market volatility.

- Multi-Asset Trading: Supports a wide range of markets, including Forex, stocks, futures, and cryptocurrencies, broadening trading opportunities.

Comparison of Exness Web Terminals with Other Trading Platforms

1. Accessibility

- Exness Web Terminals (MT4 & MT5): Both platforms offer easy access from any web-enabled device, allowing traders to manage accounts and execute trades without additional software.

- Other Platforms: While many trading systems offer web versions, Exness terminals provide seamless integration and convenience that may surpass others in accessibility and ease of use.

2. Functionality

- Exness Web Terminals: Both MT4 and MT5 terminals deliver full desktop-level functionality for market analysis, order execution, and strategy implementation, even from a browser.

- Other Platforms: Some web platforms are limited in their features, lacking certain indicators or tools available on desktop versions, which can limit the depth of market analysis.

3. User Experience

- Exness Web Terminals: These platforms are designed with user-friendliness in mind, allowing smooth navigation for both novice and seasoned traders alike.

- Other Platforms: User experiences can vary, with some web-based platforms feeling less intuitive or more complex for beginners.

4. Performance

- Exness Web Terminals: Optimized for efficient performance, these terminals minimize latency, though performance largely depends on internet and browser capabilities.

- Other Platforms: Web-based performance varies; some may experience lag, especially during volatile market events, which could impact trading precision.

MT4 vs. MT5 Web Terminal Comparison: Key Differences

While both platforms offer substantial trading tools, here are some primary distinctions between the Exness MT4 and MT5 Web Terminals:

| Feature | MT4 Web Terminal | MT5 Web Terminal |

| Timeframes | 9 options | 21 options for flexibility |

| Order Types | 4 pending orders | 6 pending orders, including stop limits |

| Depth of Market | Not available | Available for deeper market insight |

| Economic Calendar | Not available | Integrated into the platform |

| Technical Indicators | 30 indicators | 38 indicators for advanced analysis |

| Tradable Assets | Forex, metals, indices, energies | Forex, stocks, indices, futures, metals, cryptocurrencies |

Choosing the Right Platform

- MT4 Web Terminal: Ideal for traders focused on simplicity, featuring core trading tools with a streamlined approach.

- MT5 Web Terminal: Suited for advanced traders who need additional timeframes, order types, and multi-asset options.

Conclusion: Optimizing Your Web-Based Trading Experience with Exness

The Exness MT4 and MT5 Web Terminals offer traders an accessible, browser-based trading solution without compromising functionality. With a comprehensive suite of tools and smooth accessibility from any internet-connected device, both platforms deliver a trading experience close to their desktop counterparts. Choosing between them depends on the trader’s need for either simplicity (MT4) or advanced tools (MT5).

FAQ

1. What distinguishes the Exness MT4 and MT5 Web Terminals?

The MT4 terminal is straightforward and ideal for traders seeking core tools, while MT5 includes advanced features like additional timeframes, more order types, and a wider range of assets, including stocks and cryptocurrencies.